Total debt

Total debt

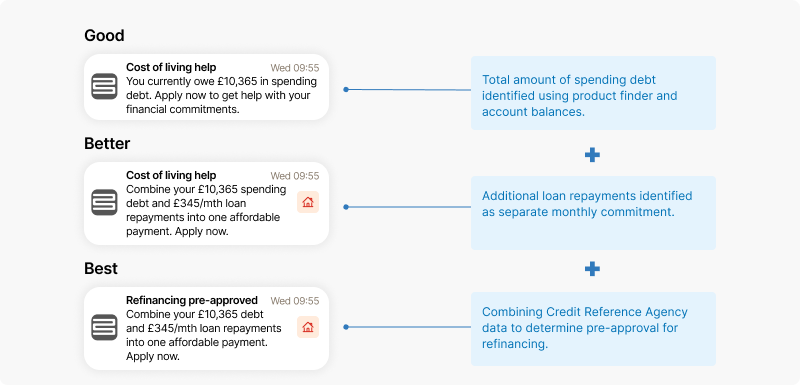

Use case - refinancing to reduce monthly commitments

With less cash available each month, it can be tempting for customers to use ‘buy now, pay later’, dip into their overdraft or utilise their credit cards more than usual. Combined with existing loan payments, these debts can soon add up.

Bring awareness of total debt upfront and personalise with added clear actions on what steps can be taken to get on top of it.

Total debt examples

APIs usedList accounts:

GET financial/v3/accounts(List accounts endpoint)Debt collection transactions:

GET v1/debt-collection(Debt collection transactions endpoint)Financial products (loans):

GET insights_v2_products(Financial products V2 endpoints)Retrieve category totals:

GET aggregations/v2/totals/categories(Category totals V2 endpoint)

Tip: combine loan data with your affordability score to pre-approve refinanced loan applications.

If you have any questions, please contact us via the chatbot (bottom-right of screen 👉) or via a support request or check our FAQs.

Updated 5 months ago