Credit cards

Essential spend on credit card

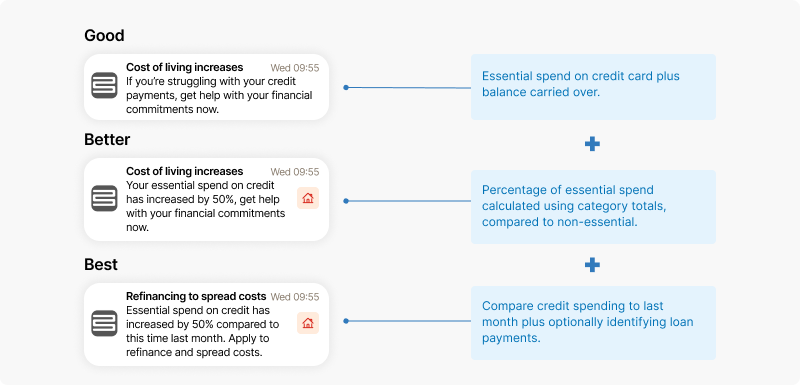

Use case - engaging customers who may be struggling with debt

As the cost of living increases, customers may find that they are having to put essential expenses like utility bills or groceries on their credit card to get them through the month. If the credit card balance is carried over each month, customers are at risk of building up high cost debt and paying interest charges that may put them into financial hardship.

Intervene early using spending patterns and credit utilisation data to highlight opportunities for your customers to get back on track. Whether it is suggesting a financial review to explore refinancing or promoting access to short term lower cost lending products, personalised messaging can help increase financial wellbeing.

Essential spend on credit card examples

APIs usedList accounts:

GET financial/v3/accounts(List accounts V3 endpoint)Balance over time:

GET financial/v2/balances(Balance over time endpoint)Financial products (loans):

GET insights/v2/products(Financial products V2 endpoints)Retrieve category totals:

GET aggregations/v2/totals/categories(Category totals V2 endpoint)

Tip: experiencing financial difficulties is an upsetting time for people, it is important to be sensitive in your communications. We have written the above examples as a guide. Follow your internal marketing team guidance when preparing your own messages.

If you have any questions, please contact us via the chatbot (bottom-right of screen 👉) or via a support request or check our FAQs.

Updated 5 months ago