Intro to Assess

Open Banking in affordability: speed, accuracy, profitability

For a long time, transactional data has been recognised as the most accurate way to understand the finances of a customer looking to purchase a financial product. For that reason, reviewing bank statements remains a key process in many parts the lending world.

However, doing so is slow and expensive, as well as being a poor experience for the applicant. Credit Reference Data can provide a solution, but is often out-of-date and can present an inconsistent view of customer's - introducing unnecessary underwriting and regulatory risk.

Assess solves that problem by allowing customers to share seamlessly their financial information with lenders directly and securely from their bank institutions and then to utilise Bud's market-leading transactional data intelligence and categorisation to identify insights and datapoints that facilitate fast and accurate affordability decisioning.

Below, you can find an introduction to how various parts of Assess, Bud's affordability solution, works. If you want to find out more, feel free to book in a demo of the solution.

Want a demo?If you'd like to organise a demo of the Assess product, please click here

Assess: Bud's suite of affordability tools

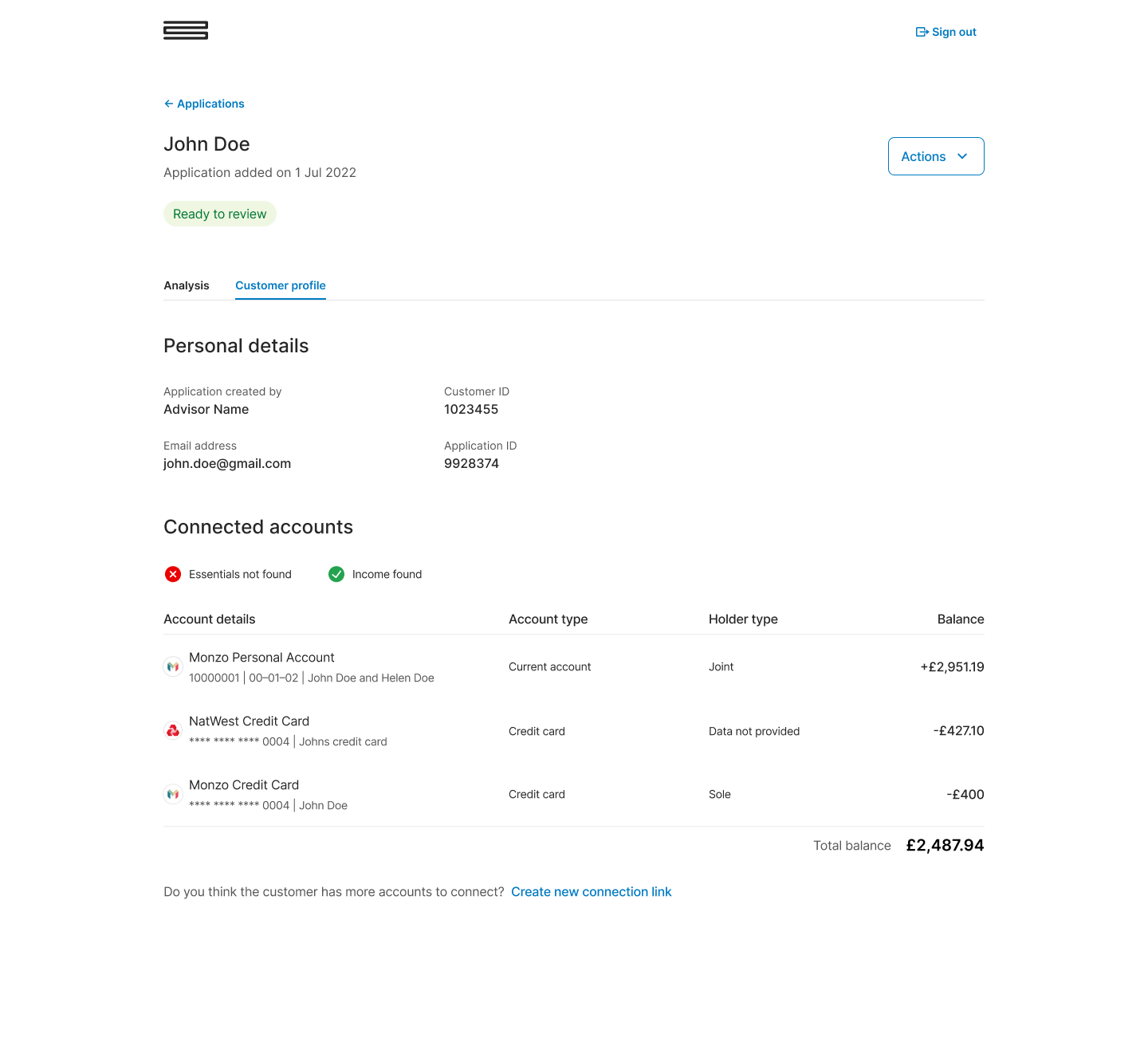

Assess is home to Bud's affordability tools: a dashboard and set of APIs which are designed to power fast and accurate credit decisioning. We utilise Bud's market-leading enrichment to cut through the noise and present a clear and concise image of a customer's financial situation.

Assess is a product that builds on top of and aggregates Bud other products: Connect and Enrichment. All these three products combine to provide you a one stop shop to streamline and sharpen your affordability processes.

Data displayed is fake and does not represent real financial data

How does Assess work?

Getting data into Assess is simple, utilising the ease of Open Banking and Bud's frictionless Connect flow. Once you initiate an application in Assess, either in the dashboard or by API, the customer is emailed a link to complete their application. You can see more detail about how to create application links via the dashboard here and via API here.

Once they've done that, Bud ingests the customer's transactions and enriches them, so that you can use either the dashboard, any of Bud's APIs, or both, to drive the affordability processes that you need.

Which product is right for you?

As mentioned above, there are two ways to access Assess products by using either:

- Assess Dashboard: our plug-and-play tool designed to offer up exactly the right information to streamline manual reviews - read more; or

- Assess APIs: where you can cherrypick the data you need to drive whatever affordability processes are most impactful for you, from income verification to decision automation - read more; or

- Both: both of the above can be used in synchronisation which is especially useful where you want to automate decisioning - using the API - and then use the dashboard as a tool to conduct manual reviews and spot checks.

To help you make that decision, read more via the links above, which explain the implementations of each, as well as some typical use-cases which clients employ these products for or speak to us, we'll be happy to help and guide you through the decision.

If you have any questions, please contact us via the chatbot (bottom-right of screen 👉) or via a support request or check our FAQs.

Updated 5 months ago