Introduction to Engage

Unlocking personalisation through transactional intelligence

For a long time, personalisation has been the holy grail of the financial services industry. Transactional intelligence underpinned by AI is now making this a reality with Bud.

After many years of refining our technology, and having enriched billions of transactions, our best-in-class enrichment models underpin a suite of tools that allow you to personalise your customer's experiences at each step of their journey.

By providing personalised experiences, Bud helps to simultaneously drive customer engagement whilst also improving loyalty, retention, and increasing customer deposits.

Want a demo?If you'd like to organise a demo of the Engage product, please click here

Engage: Bud's suite of money management tools

Engage is a suite of tools that are designed to produce personalised insights into each aspect of your customer's finances. Every tool is underpinned by Bud's market-leading aggregation (Connect) and Enrichment, in order to cut through the noise in messy financial data to provide a single holistic view of your customers.

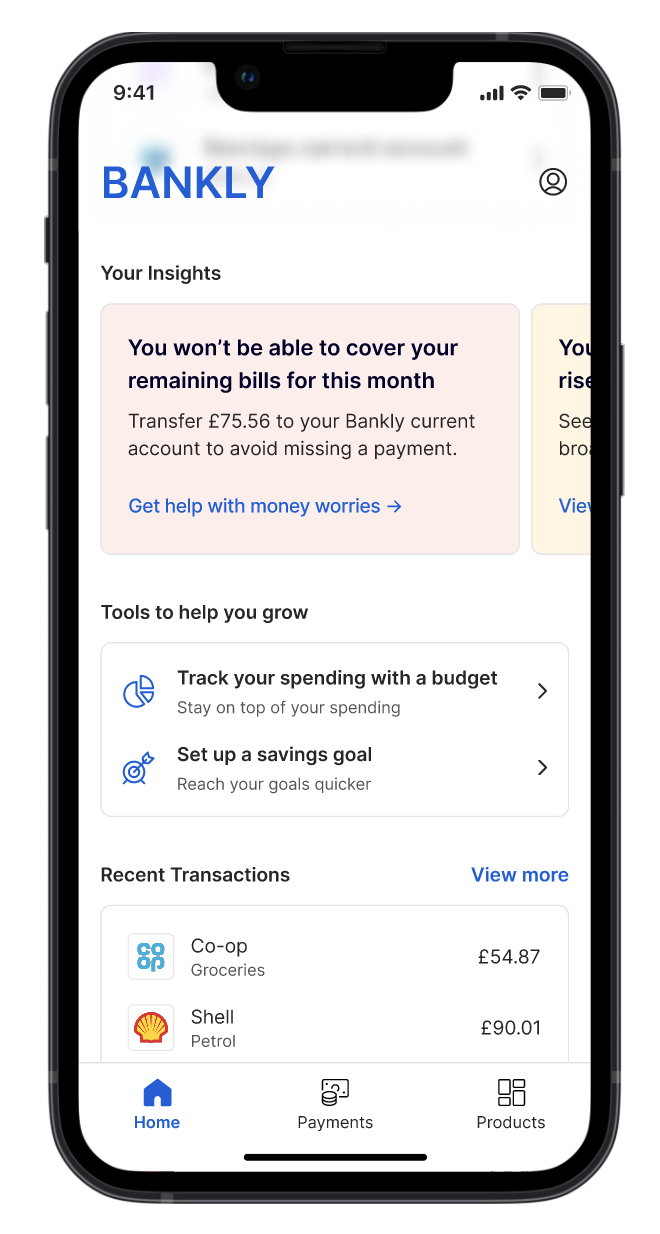

Example of existing Engage features (Engage is strictly an API product and Bud does not provide a customer facing UI)

How does Engage work?

Getting data into Engage is simple, if you're a financial organisation with existing transactional data available to you, you can utilise Bud's first party ingestion in order to stream transactional data to Bud in real time or batched. If you're looking to aggregate your customer's data from a number of different financial providers you can use Connect in order to make use of Bud's Open Banking aggregation capabilities.

Once the data has been ingested into Bud's platform, it is automatically standardised, enriched, encrypted and stored ready for you to query using one of Bud's Engage packages.

Which package is right for me?

As mentioned above, there are three packages available to customers of Engage;

- Spend Insights: provides customers with a standardised and enriched list of their customer's accounts and transactions. Enrichments include categorisation, merchant identification and regularity.

- Money management: contains our series of smart finders providing insights into your customer's income, subscriptions, loans, debt etc. As well as access to money management tools such as savings goals and spending budgets.

- Personalised engagement: includes numerous actionable insights for your customers such as cannot cover bills or subscription increases as well as the ability to create multiple custom insights.

If you have any questions, please contact us via the chatbot (bottom-right of screen 👉) or via a support request or check our FAQs.

Updated 6 months ago